coweta county property tax rate

For three years the Coweta County Tax Assessors Office with the help of a contractor has been working on a complete revaluation of all residential and agricultural property in the county. Thank you for visiting the Coweta County GA Website.

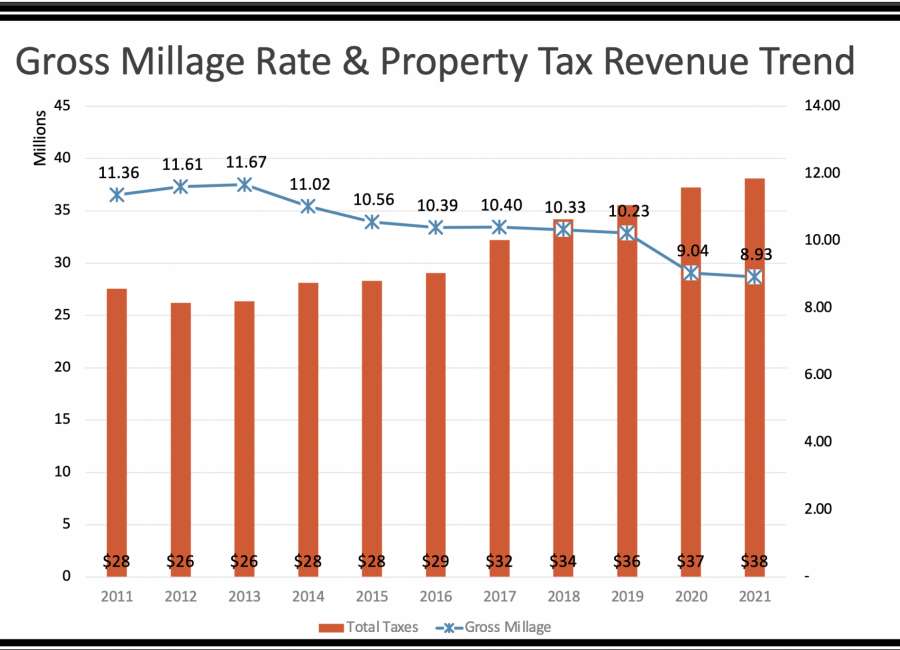

County Sets Millage Rates The Newnan Times Herald

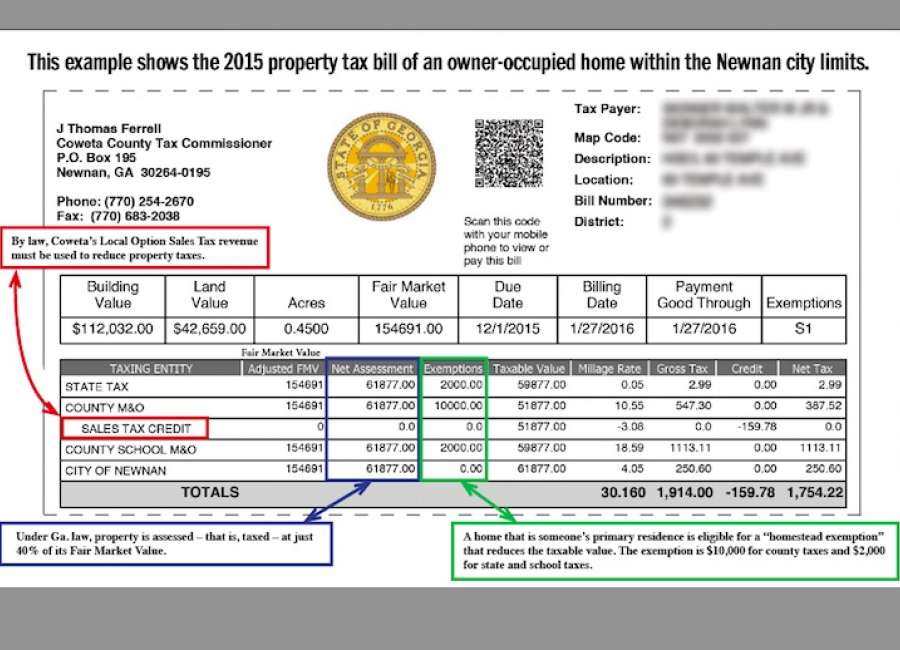

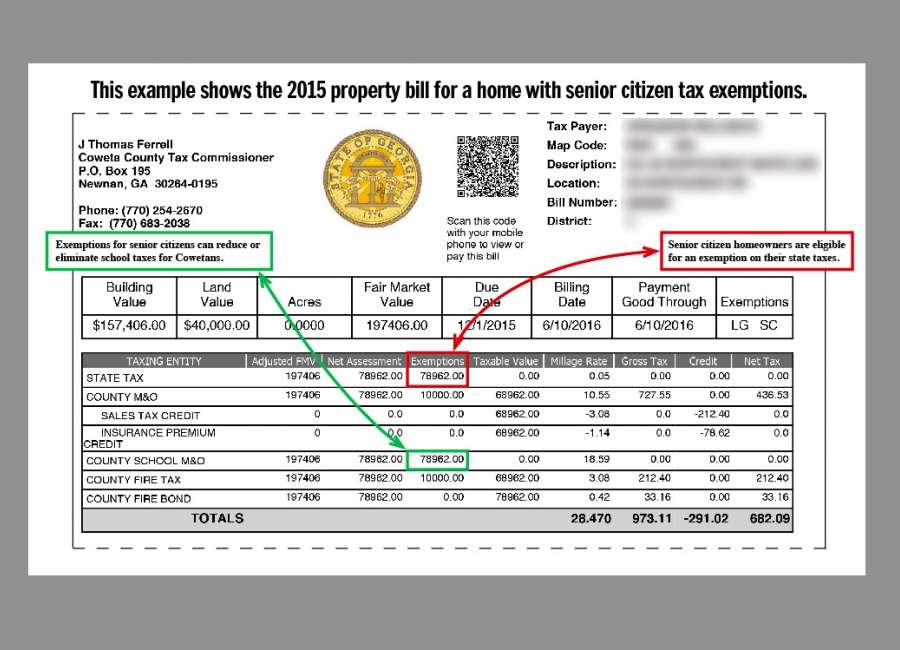

In Coweta Countythe Tax Commissioner has transferred the responsibility for accepting homestead applications to the Tax Assessors office.

. The Coweta County GA Website is not responsible for the content of external sites. Whether you are already a resident or just considering moving to Coweta County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Thank you for visiting the Coweta County GA Website.

The 2020 millage rate of 3643 was set by Council in August. Please use the link below to plan your visit. Home value.

The Coweta County GA Website is not responsible for the content of external sites. Coweta County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Object Moved This document may be found here.

You will be redirected to the destination page below in 3 seconds. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Coweta County GA at tax lien auctions or online distressed asset sales.

The Coweta County GA Website is not responsible for the content of external sites. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of 081 of property value. The Coweta County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan.

If the county board of tax assessors fails to. Thank you for visiting the Coweta County GA Website. Coweta County GA currently has 621 tax liens available as of April 19.

Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. Notice to Property Owners Occupants. Limited space is available in the lobby area.

What property is taxed. You are now exiting the Coweta County GA Website. Any qualifying disabled veteran may be granted an exemption from paying property taxes for state.

770 254-2601 Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. Each Ex-Officio Deputy She riff has full power to advertise and bring property to sale for the purpose of collecting taxes due the state and county. In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office routinely review all properties within the county.

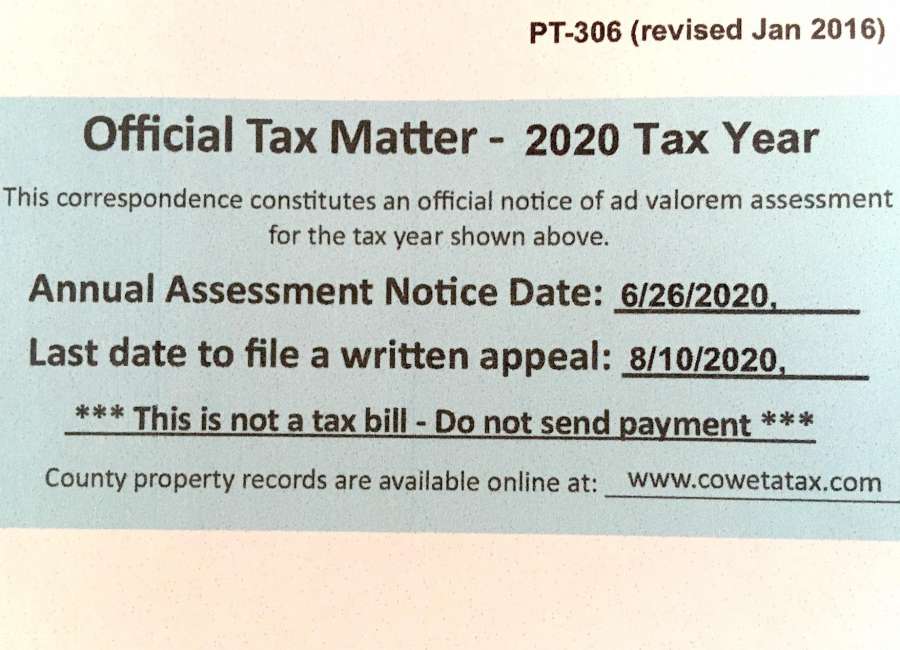

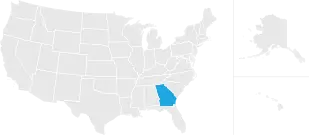

3 A In each year the county board of tax assessors shall review the appeal and notify the taxpayer i if there are no changes or corrections in the valuation or decision or ii of any corrections or changes within 180 days after receipt of the taxpayers notice of appeal. Coweta County GA. Learn all about Coweta County real estate tax.

Coweta County makes no warranty expressed or implied nor does the fact of distribution constitute such a warranty. The median property tax on a 17790000 house is 144099 in Coweta County. Everyone visiting the County Administration Building is required to enter through the East Broad St entrance.

The median property tax on a 17790000 house is 147657 in Georgia. These buyers bid for an interest rate on the taxes owed and the right to collect back. Use the Search and Pay Taxes link above to verify property tax payment received.

Board of Education and city councils to set the property tax millage rate and property taxes are due in late 2020. As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale matters. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County.

For more information visit www. You will be redirected to the destination page below in 3. Home value 500k - 750k 395.

The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. You will be redirected to the destination page below in 3. Let us handle the entire process for you - from filing the property tax appeal to negotiating with the Coweta County tax assessor and appearing at the Board of Equalization BOE hearing or with a Hearing Officer.

Property Tax Appeal Representation. The responsibility to approve or deny the exemptions has always been that of the Board of Assessors. The 2019 millage rate was 3989 mills per thousand dollars of assessed value which is slightly less than the 40 millage rate for 2018.

Coweta County Tax Commissioner. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Coweta County Tax Appraisers office. Share Bookmark Share Bookmark Press Enter to show all options press Tab go to next option.

Payments may be made to the county tax collector or treasurer instead of the assessor.

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Smartasset Coweta Ranks 7th For Best Places To Retire In Oklahoma News Tulsaworld Com

Coweta County Ga Hallock Law Llc Property Tax Appeals

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Georgia Property Tax Calculator Smartasset

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Closing Costs Michael Raab Your Coweta County Realtor