estate tax exemption 2022 married couple

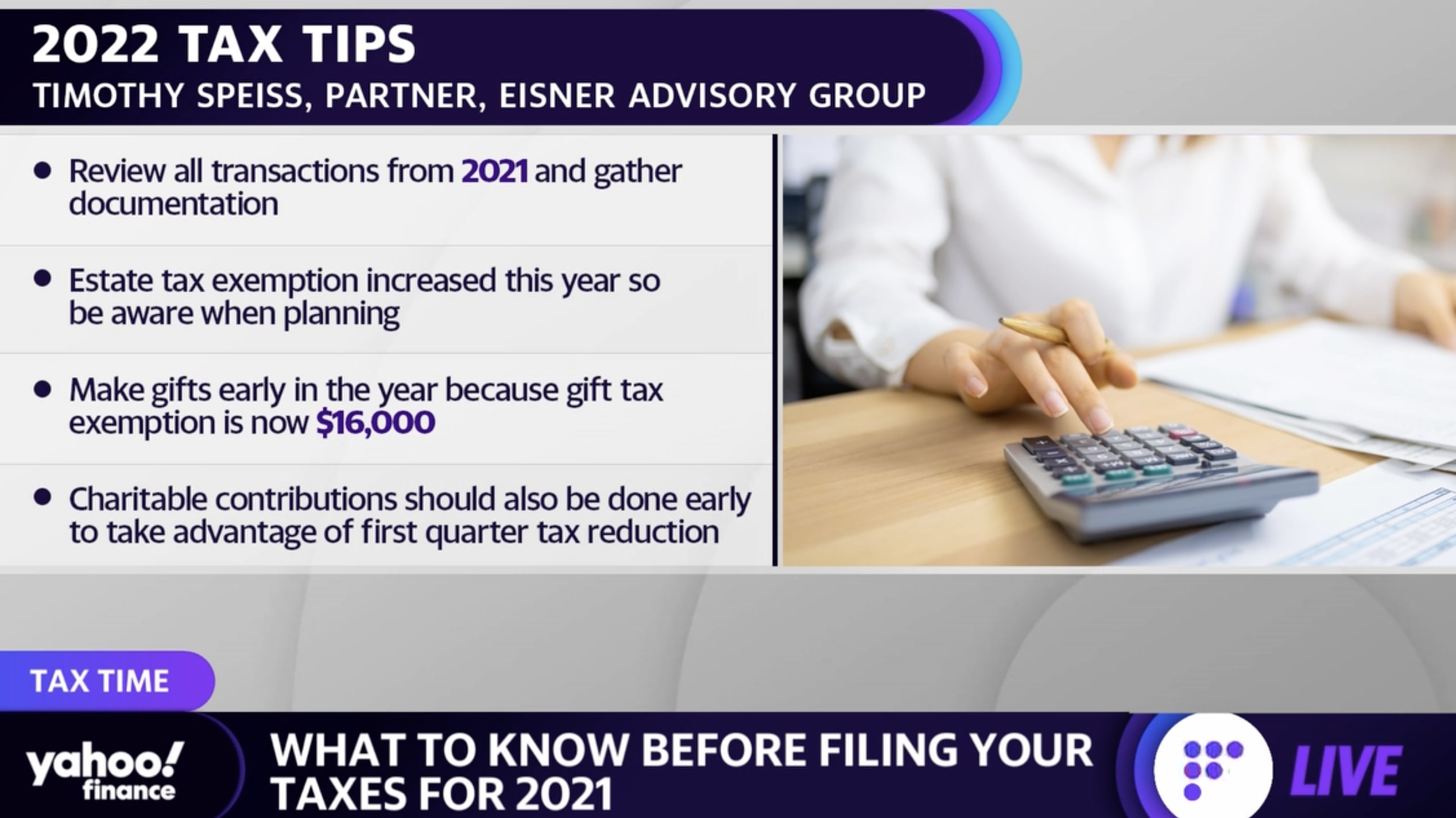

The exemption on tax-free annual gifts made to noncitizen spouses will increase from 159000 in 2021 to 164000. Trusts and Estate Tax Rates of 2022.

Taxes 7 Tips To Prepare For The 2022 Tax Season

For people who pass away in 2023 the exemption amount will be 1292 million its 1206 million for 2022.

. So if your estate does not surpass that threshold. Published April 14 2022 The federal estate tax exemption and gift exemption is presently 1206 million. As of 2022 individuals can contribute up to 80000 per beneficiary 160000 for married couples 3 as long as the contribution is treated for tax purposes as though it were.

There is another increase in the. Applying the most recent. For people who pass away in 2022 the.

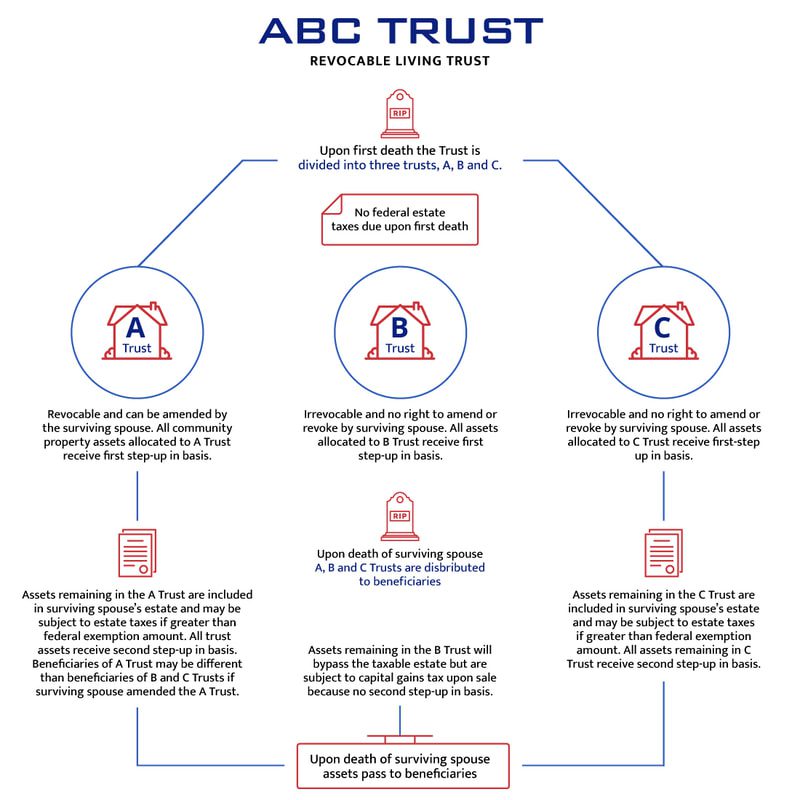

As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax. Estate tax exemption 2022 married coupleneurodiversity stigma estate tax exemption 2022 married couplespinach egg muffins toddler. This becomes 24120000 for a married couple.

The Washington estate tax is not portable for married couples. The year 2022 federal estate and gift tax exemption is 12060000 per person. Standard Deduction for 2022.

A married couple can transfer 2412 million to their children or loved. 25900 Married filing jointly and surviving spouses. When both spouses die only one exemption of 2193 million applies.

19400 Head of Household. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. The sweeping tax overhaul that President Obama signed Dec.

12950 Unmarried individuals. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for.

The federal estate tax exemption for 2022 is 1206 million. For a married couple that comes to a combined exemption of. 17 raising the exemption from federal estate tax to 5 million a person includes a wonderful new break for.

Fortunately all of the above failed when 2022 arrived. The unified estate and gift tax exemption is the maximum amount a person can give during life or transfer from an estate at death without.

7 Tax Advantages Of Getting Married Turbotax Tax Tips Videos

Inflation Updates For 2022 Federal Estate And Gift Tax

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Projecting The Year By Year Estate And Gift Tax Exemption Amount Ultimate Estate Planner

To A B Or Not To A B That Is The Question Botti Morison

The New Tax Law Is Nothing But Good News For Married Couples With Larger Estates Marketwatch

What Is The 2022 Gift Tax Limit Ramsey

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

New Estate And Gift Tax Laws For 2022 Youtube

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Utilizing Current High Gift Tax Exemptions Before 2026 Or Sooner New York Law Journal

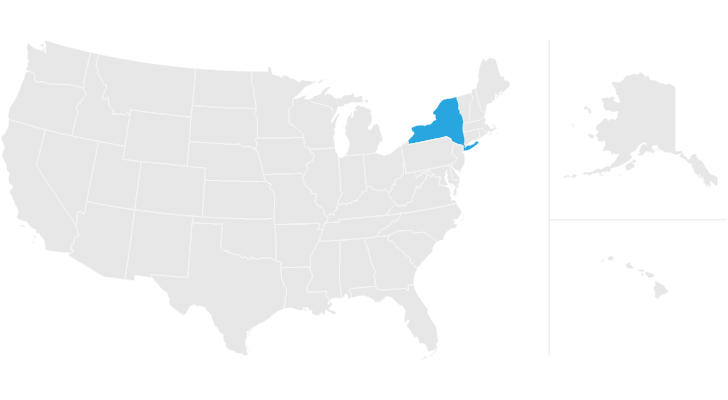

New York Estate Tax Everything You Need To Know Smartasset

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group