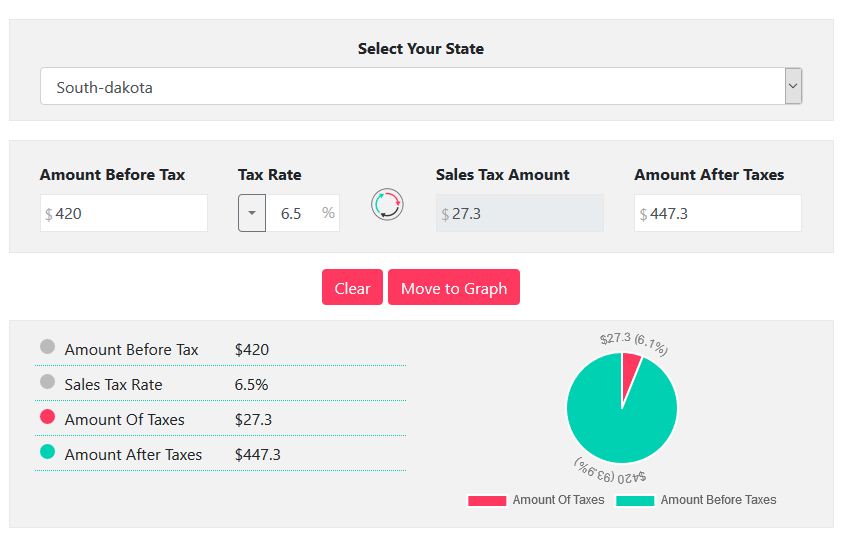

south dakota sales tax calculator

In addition cities in South Dakota have the. Chamberlain is located within Brule County.

Is Shipping Taxable In South Dakota Taxjar

Wood is located within Mellette County.

. South Dakota municipalities may impose a municipal sales tax use tax and. This includes the rates on the state county city and special levels. Just enter the five-digit zip.

Just enter the five-digit zip. The average cumulative sales tax rate in Wood South Dakota is 45. Find your South Dakota.

This includes the rates on the state county city and special levels. Stockholm is located within Grant County South. The average cumulative sales tax rate in Stockholm South Dakota is 45.

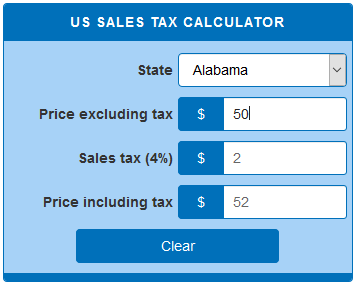

The calculator will show you the total sales tax amount as well as the. So if you live in South Dakota collect sales tax at the rate at your buyers location. The state sales tax rate in South Dakota is 4500.

The average cumulative sales tax rate in Chamberlain South Dakota is 65. The South Dakota sales tax and use tax rates are 45. Just enter the five-digit zip.

Other local-level tax rates in the state of South. The South Dakota SD state sales tax rate is currently 45. Ad Premium federal filing is 100 free with no upgrades for premium taxes.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Free tax filing for simple and complex returns. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in the state of South Dakota is 523. What Rates may Municipalities Impose. One field heading labeled Address2 used for additional address information.

The South Dakota sales tax rate is 45. One field heading that incorporates the term Date. South Dakota Sales Tax.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. The base state sales tax rate in South Dakota is 45. This includes the sales tax rates on the state county city and special levels.

Guaranteed maximum tax refund. Depending on local municipalities the total tax rate can be as high as 65. This takes into account the rates on the state level county level city level and special level.

Furthermore taxpayers in South Dakota do not need to file a state tax return. South Dakota is a destination-based sales tax state. South Dakotas state sales tax rate is 450.

Hot Springs is located within Fall River. Marketplace providers are required to remit sales tax on all sales it facilitates into South Dakota if the thresholds of 200 or more transactions into South Dakota or 100000 or more in sales to. South Dakota SD Sales Tax Rates by City.

The average cumulative sales tax rate in Marty South Dakota is 45. South Dakota municipalities may impose a municipal. Rate search goes back to 2005.

The average cumulative sales tax rate in Wallace South Dakota is 45. This includes the rates on the state county city and special levels. Wallace is located within Codington.

Marty is located within Charles Mix. Sales tax rates are subject to change periodically. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for your location.

What is South Dakotas Sales Tax Rate. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Hot Springs South Dakota is 65.

You can use our South Dakota Sales Tax Calculator to look up sales tax rates in South Dakota by address zip code. With local taxes the total sales tax rate is between 4500 and 7500.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

How To Charge Sales Tax In The Us A Simple Guide For 2022

Sales Tax Definition How It Works How To Calculate It Bankrate

State Lodging Tax Requirements

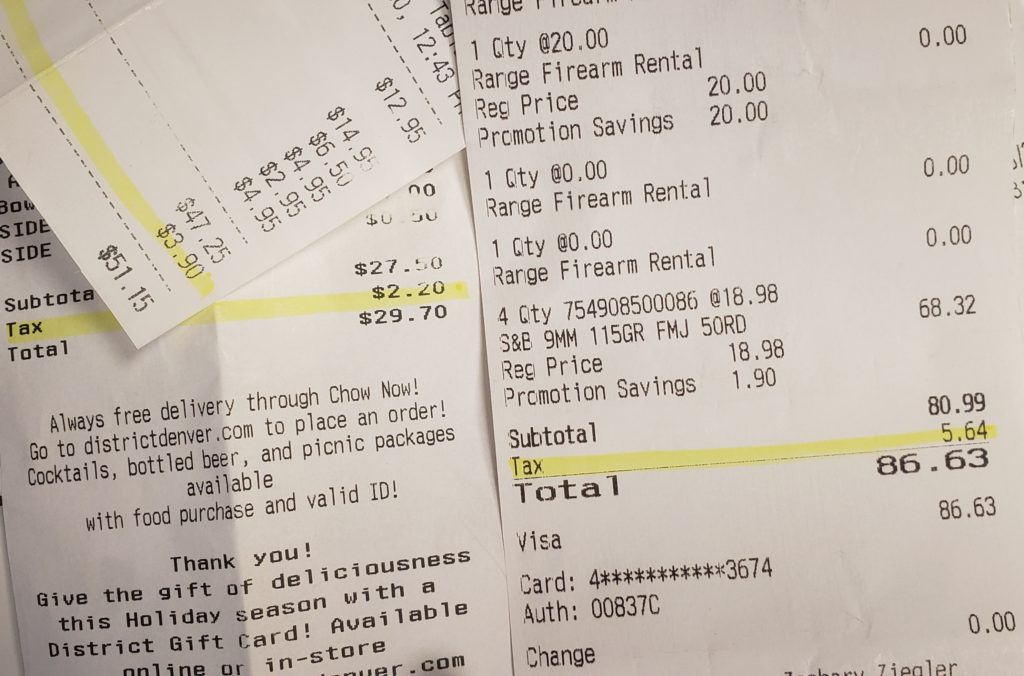

Denver Colorado Sales Taxes Increased Without Voter Consent Independence Institute

Sales Use Tax South Dakota Department Of Revenue

Us Sales Tax Calculator Calculatorsworld Com

Sales Tax Calculator Credit Karma

What Is Sales Tax A Simple Guide Bench Accounting

How South Dakota Sales Tax Calculator Works Step By Step Guide 360 Taxes

States With The Highest Lowest Tax Rates

New York City Sales Tax Rate And Calculator 2021 Wise